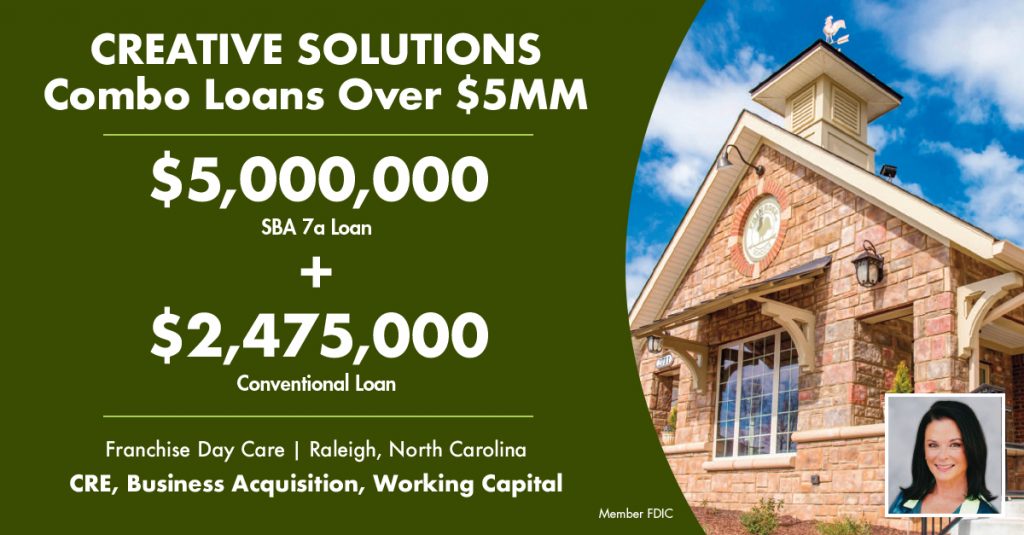

When our business development officers work with borrowers about financing their small business, on occasion, the acquisition amount is over $5MM. Today, as Berkshire Bank’s national SBA lending division, 44 Business Capital can structure an SBA plus conventional loan for up to $10MM total. Recently, Shay Barkley, FVP SBA Lending closed this franchise day care with commercial real estate and working capital. The $5,000,000 SBA 7a loan plus conventional loan for $2,475,000 financed a Franchise Day Care in Raleigh, North Carolina. The loans were for CRE, business acquisition, and working capital.

Mike DeVito, FVP SBA Lending led the way on a similar SBA + conventional loan for a business acquisition in Dallas, Texas. His borrower was able to acquire a property management company with a $5MM SBA loan plus a $1,225,000 conventional loan to make this happen. 44 Business Capital considers businesses like manufacturing, distribution, retail, medical professionals, automotive and auto body repair, motels, marinas, day care centers, car washes, restaurants or any worthwhile business.

Borrowers benefit from working directly with 44’s decision makers and can expect a quick response with flexible and sensible underwriting. Our team can assist with loans typical banks avoid due to non-monetary defaults or covenant violations. If the business model is sound and the company is trending positively, the loan will be considered.